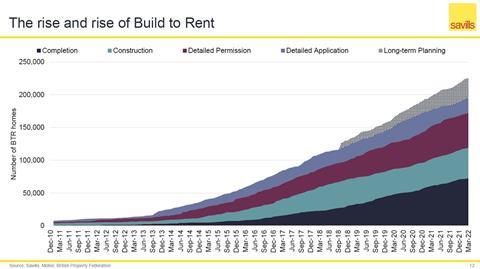

But sector grows 14% year-on-year overall

Build-to-rent starts and completions fell by 31% and 65% respectively in the first quarter of the year, analysis has shown.

Statistics released by the British Property Federation and Savills show just 1,587 BTR homes were completed in the UK in the first quarter of the year, nearly a third of the 4,591 completed in the same period in 2021. Starts also fell from 5,657 to 3,930 over the same period.

However, Guy Whittaker, associate, residential research at Savills said the drop was likely a “temporary blip” and overall annual growth of the BTR sector remains strong.

He said: “The figures in Q1 may be due to increased caution among developers, but on an annual basis the direction of travel remains positive.” It is also thought that the effects of the pandemic lockdown, which halted activity in 2020, may now be feeding through into completion figures.

Despite the fall in starts and completions, the BTR sector cumulatively grew by 14% on an annual basis. The number of BTR homes completed, under construction or going through the planning system has increased from 197,661 in the first quarter of 2021 to 225,352 in the same period last year. Regional BTR growth was 16%, outstripping the 12% seen in London.

Ian Fletcher, director of real estate policy at the British Property Federation, said the figures showed “just how rapidly the UK build-to-rent sector is expanding”.

“Completed homes increasing by a fifth in a single year is a significant leap and suggests the sector is making a strong contribution to UK housing delivery. Long-term demand for rental homes means the sector’s prospects remain very positive.”

Fletcher said there had been a shift towards larger-scale developments. BPF and Savills pointed out completed schemes were delivering an average of 140 units while those under construction were averaging 243 homes.

Although, Fletcher warned there could be “turbulence” in the built-to-rent market ahead caused by build cost inflation.

Guy Whittaker, associate, residential research at Savills, added: “New rental supply in both urban and suburban markets have the potential to sustain housing delivery volumes once Help to Buy comes to an end on 31 March 2023 and to be a vital source of high-quality housing.”

BPF figures last year showed the number of build to rent homes completed in the UK in 2020 fell by nearly a fifth as the pandemic hit, causing work on many sites to stop.

Consultancy firm JLL this month has said £1.7b built-to-rent investment deals were made in the UK in the first quarter of 2022, which represented a 50% high compared to the same period last year.

More on build-to-rent

Developer announces £1bn build-to-rent plan

No comments yet