S&P/CIPS index shows housebuilding is ‘weakest performing area of construction’ amid fears of market slowdown

Monthly housebuilding activity fell for the first time in two years in June, in the latest sign the development market is slowing down.

According to the latest S&P Global/CIPS construction purchasing managers’ index ,housebuilding was the weakest performing area of construction activity for the fourth month running, with an index reading of 49.3, down from 50.7 in May. Anything less than 50 in the index means monthly activity is declining.

The housebuilding slowdown reported in the Construction PMI data was echoed by Glenigan, which earlier this week predicted a 5% drop in project starts in the sector.

This was attributed to the removal of temporary Stamp Duty relief and dwindling homebuyer confidence, higher taxes and mortgage costs. The information provider expects a return to growth in 2023 as the economy stabilises and short-term supply chain pressures ease.

The figures come as mortgage lenders and economists warn of a slowdown in the housing market.

See also>> Are we seeing the start of a housing development slowdown?

Zoopla last Friday said annual price increases had fallen back to 8.4%, and it now expect prices to show an annual rise of just 3% across 2022 as a whole. The month-on-month rise of 0.1% is the lowest rise since December 2019, prior to the pandemic.

A day earlier, mortgage lender the Nationwide said the market was showing “tentative signs of a slowdown” after asking price growth in June fell back to 0.3%.

The figures come amid predictions of a more serious housing market correction amid the deepening cost of living crisis, rising interest rates and a stuttering economy. Capital Economics has predicted a 5% house price fall over the next two years, with housing build rates to drop to levels not seen since the financial crisis amid a slump in transactions.

See also>> Housing Today launches a campaign for a fair deal for housing

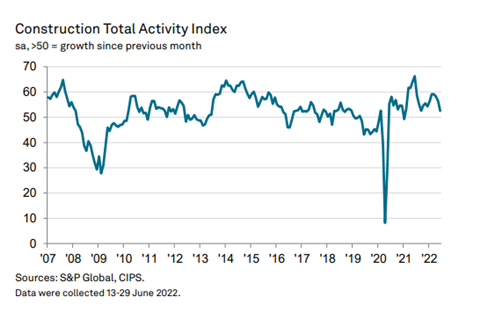

The data also shows construction activity as a whole expanding at its weakest pace for nine months. The headline seasonally adjusted index figure for June was 52.6, down from 56.4 the month prior.

New orders increased to the smallest extent since last October, while growth projections are now the least upbeat since July 2020.

Tim Moore, economics director at S&P Global, said “the gloomy UK business outlook and worsening consumer demand due to the cost-of-living crisis” had combined to “put the brakes on construction growth in June”.

Duncan Brock, group director at the Chartered Institute of Procurement and Supply, said the slowdown in the wider construction market was “in glaring contrast to the pandemic years”, when construction “held up well compared to other sectors”.

He added: “The heightened competition faced for short supply raw materials as well as essential skills for the building trade is squeezing the optimism out of builders with the lowest business expectations since July 2020.“

A Fair Deal for Housing

Housing Today believes the government should not back away from its manifesto pledge of building 300,000 new homes a year by the middle of the decade. We badly need more homes, and a lack of supply is a major factor in creating problems of affordability for both buyers and renters.

Over the next few months, Housing Today will be exploring potential solutions to help us ramp up housebuilding to 300,000. These are likely to include different ways of working, funding asks of government and policy ideas that could boost housebuilding.

We want to hear from you: what do you think can make a difference at a policy level?

What can the industry do better?

We believe that, with the right commitments from ministers and the industry, it is possible to build more homes and help the government to meet its objectives to “build beautiful”, improve quality and safety, boost home ownership and level up the UK.

Click here to find out more about the campaign

No comments yet