Newspaper reports suggest chancellor to use budget to lengthen holiday on duty for properties under £500k

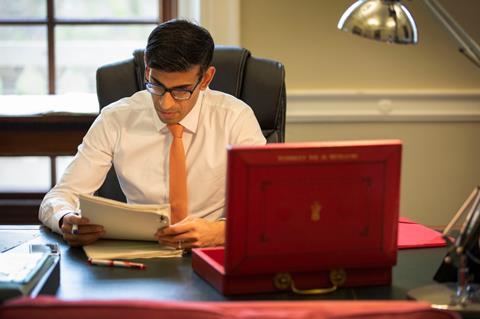

Rishi Sunak has decided to extend the current Stamp Duty holiday by three months until the end of June, amid concerns that the existing 31 March cut-off will see thousands of house sales collapse, according to reports.

The Times said the chancellor will use next week’s Budget to extend the tax holiday, which has exempted all buyers of houses under £500,000 from paying any duty at all since last July.

The holiday, credited with fuelling the surge in the housing market seen in the second half of last year, saves home buyers up to £15,000 on the cost of buying a house.

The paper did not indicate the source for the story, which follows a report in the Sunday Telegraph at the weekend that Sunak will extend the temporary stamp duty relief by six weeks.

The report also comes days after right-leaning think-tank the Centre for Policy Studies called on Sunak to extend the temporary holiday, describing the move as a “very effective form of stimulus for the construction industry”, which had given it the confidence to keep building through the downturn.

Online property portal Rightmove said the extension would allow another 300,000 transactions to complete within the holiday period, saving buyers around £1.75bn in duty.

Rightmove has previously said that, if the deadlines remains at 31 March, then 100,000 buyers who agreed purchases last year will miss out on the saving, due to extensive delays in the sale process brought on by the rush of transactions.

Iain McKenzie, chief executive of the Guild of Property Professionals, welcomed the report but called for Sunak to find a way to phase out the extension gradually. He said: “While it would be positive to see an extension, an abrupt end to the stamp duty holiday, whenever it happens, could cause harm to the economy and disrupt the property market.

>> Will Sunak heed the pressure to extend stamp duty cut?

“A gradual phasing out of the scheme would ensure that consumers still waiting to complete are not hit in the wallet and would make more sense, as a cliff-edge at any time is an unnecessary threat.”

Government figures released yesterday showed that residential transactions were at their highest January figure for 13 years last month following the surge in house sales in the wake of the stamp duty holiday, and as homeowners reassess their living situations in the light of the pandemic.

According to the ONS, house prices rose 8.5% last year as the market rebounded, however sales appear to be weakening this year in light of the latest lockdown and the expectation of the end of the stamp duty relief.

No comments yet