Mortgage lender registers first drop since June last year as stamp duty holiday nears end

House prices have fallen month on month for the first time since the 2020 spring lockdown, according to the latest survey from the Nationwide.

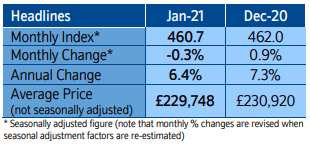

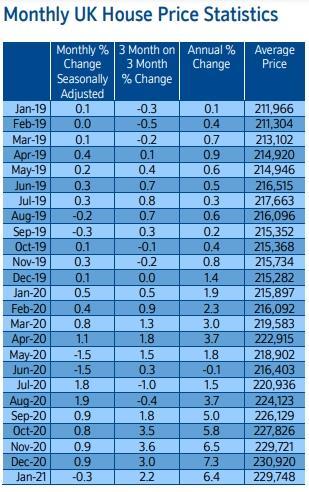

The mortgage lender said that house prices dipped by 0.3% in January, after six solid months of increases since lockdown restrictions were eased at the end of June.

The fall is not unexpected, coming after online property portal Rightmove has reported three months of “asking price” falls in its own monthly surveys.

The 0.3% drop means that prices are still up by 2.2% on a quarterly basis, and up by 6.4% year-on-year.

Robert Gardner, Nationwide’s chief economist, said the fall probably reflected a tapering of demand ahead of the end of the stamp duty holiday, which is due to expire on March 31, but that further falls could be on the cards.

Gardner said the typical relationship between the housing market and broader economic trends appeared to have broken down over the past nine months, with sharp price rises despite a big contraction in economic output, because peoples’ housing needs had changed as a direct result of the pandemic.

He said: “Looking ahead, shifts in housing preferences are likely to continue to provide some support for the market. However, if the stamp duty holiday ends as scheduled, and labour market conditions continue to weaken as most analysts expect, housing market activity is likely to slow, perhaps sharply, in the coming months.”

The figures follow the publication of Bank of England mortgage approvals data yesterday which showed the first dip in approvals since the height of the spring lockdown. However, despite a collapse in mortgage lending in the spring, the extent of the bounce back in the second half of the year was such that for the year as a whole, mortgage approvals registered their highest figure since 2007.

1 Readers' comment