Year-on-year decline in average house prices for October was greater than it was in September

Average house prices in the UK have decreased by 1.2% in the 12 months to October 2023, compared with a decrease of 0.6% in the year to September 2023.

Source: Office of National Statistics

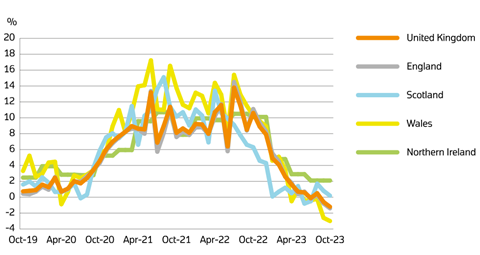

Annual house price change in the UK by country over the past five years

The latest UK House Price Index, published by the Office for National Statistics (ONS) using data from the Land Registry, shows that the average UK house price was £288,000 in October this year, which is £3,000 lower than 12 months ago.

Provisional estimates indicate that in England average house prices fell by 1.4% year-on-year to October 2023, while Wales saw a decrease of 3%.

By region, London, the South-east and the East of England experienced the highest decreases in average house prices. London house prices fell by 3.6%, and average property prices in the South East and East of England decreased by 2% and 2.3% respectively.

See also >> House prices rise in November as interest rate expectations ease

See also >> Average house price drops £7,000 in December, says Rightmove

Average house prices in the North East increased by 0.2% in the year to October 2023, making it the only English region to see a rise in property prices.

Between September and October 2023, average house prices in the UK decreased by 0.3% on a seasonally adjusted basis.

UK house price annual inflation has been generally slowing since July 2022, when annual inflation was 13.8%.

ONS data on consumer price inflation indicated that November’s inflation rate stood at 3.9%, down from 4.6% in October.

This follows the Bank of England’s decision earlier this month to keep interest rates at 5.25%.

Tom Bill, head of UK residential research at Knight Frank, said: “Downwards pressure on mortgage rates has increased after inflation fell faster than expected today, which means the property market should see a seasonal pick-up in transactions next spring in a way that didn’t happen this autumn.

”A strong jobs market, the availability of longer mortgages, the fact more homes are owned outright than with a mortgage and the absence of forced selling due to tighter mortgage stress-testing rules since the global financial crisis have all helped avoid steeper price declines. Next year’s general election has become the biggest uncertainty facing the market but the worst of the economic news increasingly feels behind us.”

No comments yet