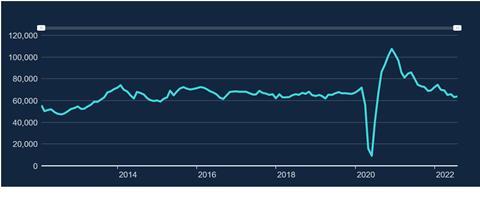

Bank of England says mortgage approvals remain below pre-pandemic level

Mortgage approvals and mortgage lending both rose slightly in July, according to the latest Bank of England data, despite growing fears of a downturn in the housing market.

However, the figures show that the number of mortgage approvals for house purchases remains below the average for the year prior to the pandemic, continuing to suggest a much weaker market ahead than has been seen since 2020.

The Bank of England said that gross mortgage lending increased to £26.1bn in July, up from £24.6bn in June, and well above the £15.6bn recorded in the same month last year, in the wake of the cancellation of the temporary stamp duty cut the month before.

The number of mortgage approvals for future loans for house purchases grew by 0.9% to 63,770 – the fourth consecutive month the figure has been below the pre-pandemic average of 66,800.

The news comes amid fears of a downturn in the housing market, with reports of falling house prices, and widespread concerns over rising energy prices and the impact of inflation and interest rate increases.

Lawrence Bowles, director of research at Savills, said that because of the strong start to the year, the number of mortgage approvals so far this year, at 471,665, was still more than in any year between 2017 and 2020.

He said the relative strength of the market now was probably due to buyers “pulling the trigger now to lock in today’s [interest] rate rather than paying even more later”. However, he said Savills is forecasting that activity will slow as winter creeps in, and given higher interest rates and rocketing energy bills.

No comments yet