Official forecaster says prices will drop by 10% in current market downturn

House prices are expected to fall by 10% in the current downturn according to the latest forecast from the Office for Budget Responsibility – an even bigger fall than it expected last autumn.

The OBR said the drop was caused by the “squeeze on real incomes” and an expectation of further mortgage rate rises, which will continue to weigh on housing market activity.

The forecast, produced to accompany chancellor Jeremey Hunt’s Budget yesterday, stated that house prices are predicted to decline by exactly 10% from their peak in the fourth quarter of last year, to a low in the third quarter of 2024.

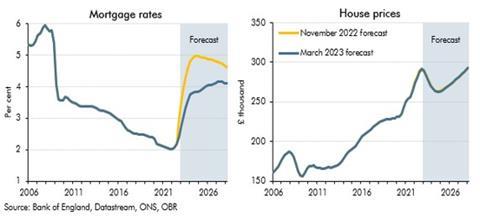

The OBR’s forecast of a 10% drop is an increase on the 9% drop forecast just four months ago, at the time of the November autumn statement, and comes despite the OBR significantly reining in its expectations of average mortgage rates in the months ahead.

The forecaster said the volume of property transactions will fall further, by 20% relative to their 2022 peak.

The forecast is likely to come as a blow to housebuilders hoping that recent evidence of better than expected visitor numbers on sites and Halifax’s report of a month-on-month increase in prices in February were signs the housing market was heading for a soft landing.

The public finances watchdog increased the expected peak-to-trough fall in house prices after reflecting a slightly higher peak in average prices in the fourth quarter of last year than previously expected, at £291,700, before dropping to a slightly lower nadir of £262,7000 in the summer of 2024.

According to the organisation’s forecast, average prices will only manage to top their 2022 peak by the first quarter of 2028. The OBR said data from mortgage lenders the Halifax and Nationwide suggested that house prices had already fallen by 3-6% from their mid-2022 peak. It said: “Low consumer confidence, the squeeze on real incomes, and the expectation of mortgage rate rises to come are expected to contribute to continued falls in house prices and a reduction in housing market activity.”

This came despite the fact the OBR now expects the average rate paid by mortgage borrowers to peak at just 4.2%, rather than the 5% expected in November. This peak will not come until 2027, it said, given the time taken for increases in mortgage rates to be felt by borrowers with fixed rate products.

The OBR said: “With more than 80 per cent of mortgages on fixed-term contracts and the prevalence of fixed-rate mortgage contracts with terms of more than two years having risen in recent years, the increase in rates on new mortgages over recent months will take several years to feed through to the average mortgage rate.”

The value of housebuilders on the Stock Exchange initially rallied after the Budget announcement yesterday at 12.30, before falling back in the afternoon to almost exactly the same level as prior to the announcement.

No comments yet