UK Finance warns cost-of-living crisis is hitting demand for mortgage credit

Mortgage lending fell to the lowest level since the pandemic in the first three months of the year, according to UK Finance.

The lenders’ body said lending to first time buyers and homeowners fell to the lowest level since Spring 2020, during the pandemic. Excluding the pandemic disruption period, first time buyer numbers fell to their lowest since 2009, during the global financial crisis.

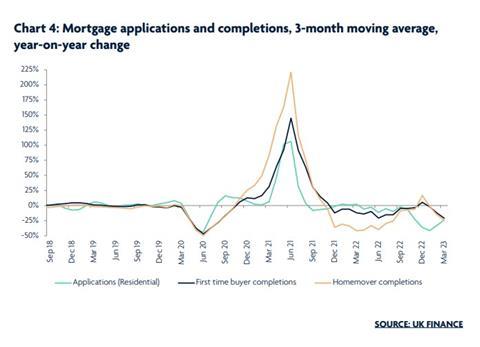

The three-month-average figures for lending and completions in March was around 25% down year-on-year, (see chart below)

UK Finance said: “This decline in activity is in line with our expectations, as set out in our Market Forecasts; cost-of-living and interest rate increases seen over the course of 2022 are now baked into household budgets and, therefore, affordability calculations, and this is bearing down on effective demand for mortgage credit.

“Looking ahead to Q2, applications data suggest the rate of contraction has moderated. However, volumes were still 25 per cent lower than in Q1 2022, indicating the softer lending market is set to continue at least over the coming months.”

The figures are the latest indicator of a slowing market. Halifax this morning reported its first year-on-year price drop for over a decade, while Nationwide last week reported the fastest fall in prices for almost 14 years.

No comments yet