Official figures show loan approvals in December hit lowest level - covid aside - for 14 years

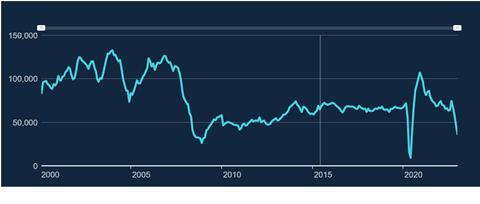

Mortgage approvals fell to their lowest level – covid aside – for almost 14 years in December, according to the latest official data.

The Bank of England said that 35,612 mortgages were approved for house purchase in the month, a 23% month-on-month drop on the November figure, and the lowest level since the height of the pandemic in May 2020.

Aside from the pandemic, the December figure, coming in the aftermath of the disastrous September mini budget that saw interest rates spike to an average of over 6%, is the lowest number of mortgage approvals seen in any month since February 2009 just after the global financial crisis.

It is also a drop of more than 50% from the number of mortgage approvals seen in the same month in 2021.

However, data from the Bank of England monthly Money and Credit stats showed that the actual amount of money lent to house buyers in December had so far been more resilient, with gross lending dropping just 7% in December, to £23.3bn.

Lucian Cook, head of residential research at Savills, said the numbers reflected a period of significant uncertainty and disruption in the mortgage markets, and were a “clear sign that it will be a challenging year for the housing market, especially with the expectation of a further increase in bank base rate on Thursday.”

Savills forecasts that the UK house prices will fall by 10% in 2023. Cook said the mortgage approvals numbers suggest it will be a “price-sensitive, low-transaction market” in 2023, “dominated by needs based buyers and weighted to those with a decent chunk of housing equity behind them”.

He added that this will favour prime housing markets, which are expected to see smaller price falls.

Downloads

Bank of England _ mortgage approvals

PDF, Size 58.31 kb

No comments yet