Nationwide index shows 0.2% fall

Estate agents remain confident of an improving housing market this year despite a 0.2% drop in Nationwide’s house price index in March.

The latest figures, published this morning by the building society, showed the average house price in the country had hit £261,142.

While this was a slight month-on-month decline in the seasonally adjusted index, the annual change was positive (1.6%).

Robert Gardner, Nationwide chief economist, said that while activity had picked up from the weak levels seen towards the end of last year, it remained “relatively subdued by historic standards”, reflecting the impact of higher interest rates on affordability.

Despite the decline in house prices in March, estate agents were optimistic. Benham and Reeves director Marc von Grundherr said the decline should be viewed as “nothing more than the market pausing for breath before the floodgates open”.

He said the annual growth figure showed the market was “very much heading in the right direction” and said it was “full steam ahead for the remainder of the year”.

Foxtons chief Guy Gittins said the market had “well and truly sprung into action in recent months”, with a “notable uplift” in sales enquiries, viewings requests and the number of offers being submitted.

“It’s fair to say that the green shoots of positivity seen since the closing stages of last year are blossoming and this is helping to cultivate positive house price growth,” he said.

>>See also: UK housebuilding recession: How much worse is it going to get?

Gardner agreed that consumer sentiment appeared to be improving as cost-of-living pressures eased, noting surveyor reports of a pickup in new buyer enquiries and new instructions to sell in recent months.

“Moreover, with income growth continuing to outpace house price growth by a healthy margin, housing affordability is improving, albeit gradually,” he added.

“If these trends are maintained, activity is likely to gain momentum, though the pace of the recovery is still likely to be heavily influenced by the trajectory of interest rates.”

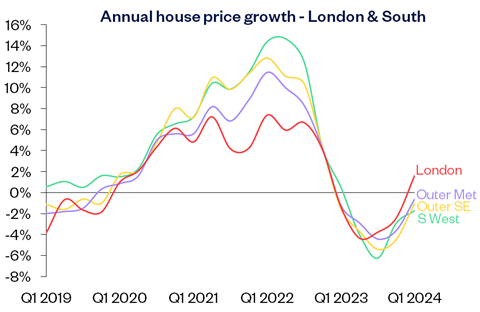

Northern Ireland was the best performing area compared with Q1 in 2023, with prices up 4.6%, while southern England saw falling prices everwhere except London, the South West being the weakest performer (-1.7%).

No comments yet