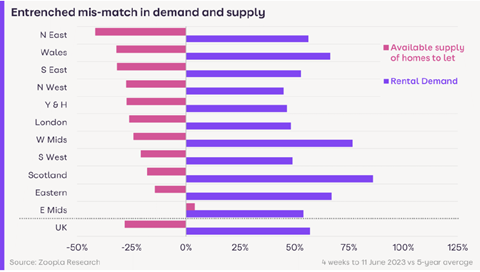

Rental prices now the least affordable for a decade with supply stuck 20-40% below pre-pandemic levels

The number of homes available for rent remains stuck 20-40% below pre-pandemic levels in most regions, fuelling competition and driving prices up, according to Zoopla.

In its latest rental market report, the property portal suggests that the impact of higher mortgage rates on the sales market is likely to deliver better rental supply in the second half of this year, but only if mortgage rates remain at over 5.5% for much of the summer.

“The chronic imbalance between supply and demand continues to push rents higher but we expect increasingly stretched affordability will start to reduce the pace of rental growth into 2024,” Richard Donnell, executive director at Zoopla, said in a statement.

The report reveals that for the last 21 months UK rents have been growing faster than wages and now account for 28.3% of average pre-tax earnings, making rental affordability its worst for a decade in seven of the 12 regions of the UK the report examines.

While renting in London is the most expensive of all regions (averaging 40% of gross earnings), it is still below the peak of 43% reached in September 2015. At a city level, rental growth is highest in Edinburgh (13.7%), followed by Manchester (13%), Glasgow (12.3%) and Southampton (10.7%)

The report suggests rental growth will slow to 8% by the end of the year, which will still be above earnings growth.

The data shows a constant flow of private landlords selling up. However, the report suggests this has been the case since 2018 and the rate of landlords leaving the market is not accelerating.

There has been no change in the number of privately rented homes since 2016, due largely to new investment in rentals by corporate landlords and institutional investors.

One in 10 homes currently for sale on Zoopla were formerly rented out.

“A proportion of landlords continue to sell but talk of an exodus is overstated,” Donnell said.

“The real pressure of higher mortgage rates on landlords hits the 20-30% with the highest loan-to-value mortgages where landlords may need to inject extra capital when they refinance or look to sell. Half of all landlord sales are in London and the South East where yields are lowest and the economics of being a landlord are toughest.”

No comments yet