Latest figures paint positive picture

UK house prices rose 0.7% in January after plateauing at the end of last year, according to figures from Nationwide.

The building society’s latest House Price Index, published this morning (Wednesday), showed average prices increased to £257,656 this month, from £257,443 in December (not seasonally adjusted).

It marks a return to growth in house prices, although Nationwide warned that a “rapid rebound in activity or house prices in 2024” remained unlikely.

Chief economist Robert Gardner said the outlook was “a little more positive” nonetheless, with a recent RICS survey showing that the decline in new buyer enquiries had halted.

There was also an improvement in the annual rate of house price growth, from –1.8% in December to –0.2% this month, the strongest performance since January 2023.

Gardner said there had been “encouraging signs” for potential buyers, with mortgage rates trending down.

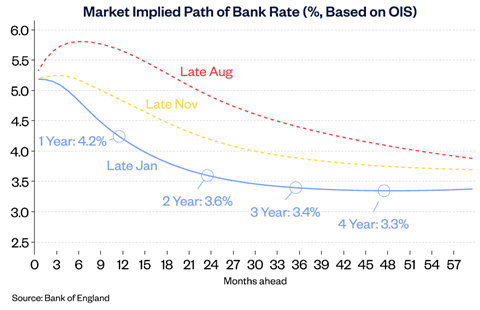

“This follows a shift in view amongst investors around the future path of Bank Rate, with investors becoming more optimistic that the Bank of England will lower rates in the years ahead,” he said.

>> Read more: UK house prices fell 2.1% in year to November, says ONS

“These shifts are important as this led to a decline in the longer-term interest rates (swap rates) that underpin mortgage pricing around the turn of the year.

“However, the partial reversal in recent weeks in response to stronger than expected inflation and activity data cautions that the interest rate outlook remains highly uncertain.”

He said the evolution of mortgage rates this year would be “crucial”, citing affordability pressures as a key factor holding back the market in 2023.

There was considerable variation in affordability across the country, with acute pressures in London, the South of England and East Anglia. Scotland and the North were more affordable.

No comments yet