Market ‘showing signs of cooling’ but lack of supply means growth is still historically high

House prices in May rose at their slowest rate since the start of the year, according to the Halifax.

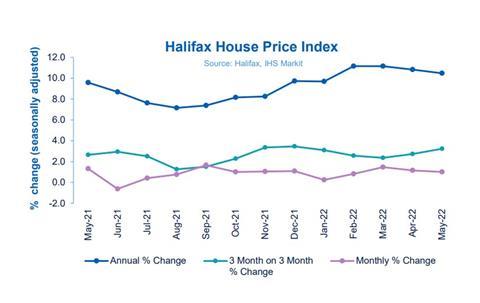

The mortgage lender’s monthly house price index shows annual price growth has slowed slightly, although it remains historically high at 10.5%. Annual growth has slowed in each of the last four months, following a 15-year high of 10.8% in February.

Monthly house prices have now risen for 11 months in a row with the average house price now at a record £289,099, the data from Halifax and IHS Markit shows.

Russell Galley, managing director of Halifax, said the “imbalance between supply and demand” remains the main reason why prices are continuing to rise despite cost of living pressures.

He added: “The housing market has begun to show signs of cooling. Mortgage activity has started to come down and, coupled with the inflationary pressures currently exerted on household budgets, it’s likely activity will start to slow.”

The Halifax findings echo data from lender Nationwide last week showing that year-on-year price growth has slowed for two successive months to 11.2% in May.

Bank of England data last week also suggested that the bank’s decision to raise interest rates may be having an impact on mortgage lending.

The data shows monthly net mortgage debt fell by a third in April to £4.1bn following increases to the base rate of interest. Mortgage approvals also fell from 69,500 in April to 66,000 in March, with both approvals and mortgage debt slightly below their 12-month pre-pandemic average for the year to February 2020. The Bank of England increased its base rate from 0.25% to 0.5% on 3 February and then to 0.75% on 17 March and 1% on 5 May.

See also>> Are we seeing the start of a housing development slowdown?

See also>> House price growth slows as mortgage approvals drop to below pre-pandemic levels

Geoff Garrett, director of mortgage broker Henry Dannell, said: “A slower rate of house price growth is always likely to follow a reduction in buyer demand and that’s certainly what we’re now seeing following a dip in mortgage approval activity at the start of the year.”

“However, it remains to be seen as to whether this more tentative approach will reverse upward house price trends completely, as insufficient stock remains an issue in the current market.”

No comments yet