Gresham House-owned investment trust seeks to expand shared ownership portfolio

Residential Secure Income PLC (ReSi) has signed an agreement to purchase shared ownership homes from social impact developer HSPG.

ReSI, an investment trust owned by asset manager Gresham House, has acquired an exclusive option to buy homes from HSPG’s pipeline upon completion. ReSI expects to buy £50m of properties through the agreement over the next three years as part of the deal, which will see HSPG responsible for letting and managing the properties.

The first transaction under the partnership has been completed, with ReSI buying 21 homes in a 197-unit Laureate Fields development in Felixstowe, Suffolk. This brings ReSI’s shared ownership portfolio to 725 homes.

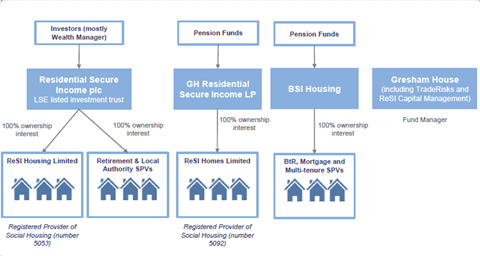

ReSI PLC is a listed trust with at least £350m invested in later living and shared ownership through its for-profit registered provider ReSi Housing, . Gresham House also owns another for-profit RP, ReSi Homes, which serves as a vehicle for ReSi PLC to invest up to £300m per year from local authority and other pension funds into new build shared ownership.

Gresham House, which purchased social housing fund manager TradeRisks in 2020, in total holds more than £700m of investment in 4,500 homes.

HSPG is a social impact investor set up by real estate investment specialist Guy Horne and residential investment portfoilio expert David Searle to ‘solve the UK homelessness crisis.”

See also>> Orr-inspiring: David’s remedy for the housing crisis

HSPG says it has invested more than £400 in 4,500 homes. In 2020, it acquired for-profit registered provider Park Properties Housing Association to enable it to access section 106 opportunities.

Ben Fry, managing director of housing at Gresham House said: “The transaction will add further inflation-linked, income-generating assets, whilst helping to bring forward much needed affordable housing,”

Guy Horne, chief executive at HSPG, said: “Gresham House is a natural partner for HSPG, and we are delighted to have secured this deal with one of the UK’s most respected affordable housing investors.

“As we continue to grow our presence in the competitive UK property development market, this funding provides further confidence that we will be able to deliver socially impactful housing for communities up and down the country.”

No comments yet