Construction’s largest sector hit by interest rate hikes as CPA says wider indsutry will slump by more than 6% this year

Private housing output will contract by nearly 20% this year as a direct result of higher mortgage rates caused by Liz Truss’ disastrous mini-budget, according to a new report.

The Construction Product Association’s (CPA) spring forecast found private sector newbuild housing will suffer the sharpest fall of any construction sector in 2023 before rebounding in 2024.

It said the private housing output will fall by 17%, with public sector housing output dropping by 15%. Private housing starts will fall by a fifth, it forecasts. An absence of stimulus for home buying in the March Budget, falling real incomes and ongoing cost of living pressures will all weigh on housing demand over the course of this year, the forecast said.

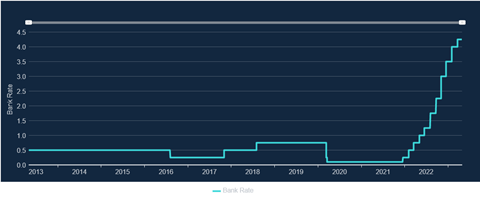

The Bank of England started raising interest rates to curb inflation in early 2022 from a historic low of 0.1%. In the last quarter of the year rates jumped to 3% in the wake of Truss’ tax-cutting budget, and now stand at 4.25%, the highest for 15 years.

The CPA has also downgraded its forecast for the wider construction sector, with output across the industry now expected to shrink by 6.4% in 2023 compared to the 4.7% expected at the beginning of the year.

The other main driver of the contraction was found to be private housing repair and maintenance, which is expected to slump by 9% this year.

The CPA said the slower demand is partly due to the fading impact of a boost in repair and maintenance jobs during and immediately after the pandemic. Together, private housing new build and private housing repair and maintenance account for around 40% of total construction output.

The CPA’s head of construction research Rebecca Larkin said that the sharp falls in these two sectors meant that a construction recession in 2023 will be “unavoidable”.

“Despite the improvement in the outlook for the UK economy compared to six months ago, the headwinds of falling real incomes and interest rate rises remain,” she said.

However, she said it was important to note that the starting point for the contraction is a record-high level of activity seen after the pandemic and the 6.4% contraction would be smaller than during other construction recessions of 2008/09, 2012 and 2020.

Infrastructure output growth in 2023, which had been set at 2.4% in the CPA’s winter forecast, has also been downgraded to 0.7% following the government’s decision to pause work at HS2’s Euston terminus and other projects, including road upgrades.

Output growth in that sector, the industry’s third largest, is now expected to be 1.2% next year, compared to the 2.5% forecast in winter.

Larkin said that unlike the relatively fast bounce back expected for housing in 2024, the prospect of delays leading to cost overruns on large infrastructure schemes poses a longer term risk.

No comments yet