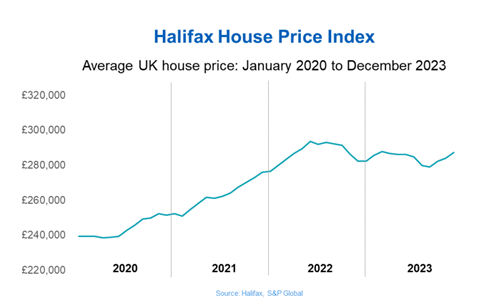

December house price index suggests fall in house prices of more than 2% in 2024

The average house price has risen for the third month in a row - the highest monthly increase since March 2023 - according to Halifax

The average price rose 1.1% in December compared to the previous month, increasing by £3,066 to £287,105.

The 1.1% increases follows a 0.6% increase in November month-on-month.

The latest Halifax house price index, released today, has indicated that house prices in December 2023 were 1.7% higher than in the same month last year. This means the average property price is now £4,800 higher than it was in December 2022.

However, today’s forecast has suggested that house prices could fall by between 2% and 4% in 2024, but that uncertainty remains high due to the current economic climate.

Regionally, house prices in Northern Ireland continued to be the strongest performing in December 2023.

Scotland’s average house price also recorded growth, with the average property price now 2.6% higher, or £5,277 in cash terms, on an annual basis.

The North-west saw a house price increase 0.3% over the last year, while Yorkshire and Humber experienced a 0.1% rise in house prices.

House prices in the South East fell the most during 2023, when compared to other UK regions, with homes selling for an average £376,804, a drop of £17,755, marking a 4.5% decrease.

London continues to have the highest average house price across all the regions, at £528,798, despite prices in the capital having fallen by 2.3% on an annual basis.

Kim Kinnaird, director at Halifax Mortgages, said that the housing market had beaten expectations in 2023.

Kinnaird stated: “While it’s encouraging that we saw growth in the last three months of the year, this was preceded with property price falls for six consecutive months between April and September. The growth we have seen is likely being driven by a shortage of properties on the market, rather than the strength of buyer demand. That said, with mortgage rates continuing to ease, we may see an increase in confidence from buyers over the coming months.”

>>See also: Approvals rise despite historically low annual mortgage growth

>>See also: Let’s hope for a long-term plan for housing in 2024

Kate Steere, deputy editor and housing expert at personal finance comparison site finder.com, said: “It’s likely that house prices are stabilising off the back of the recent base rate pauses and fall in inflation. However, the reality is that the cost of borrowing remains very high despite lenders reducing rates over the last week. In November, a panel of experts surveyed by finder.com predicted that house prices would fall between 5% and 10% in 2024. Now that rates are beginning to come down and there are expectations that the base rate will fall this year, I’m hopeful that we will no longer see such a significant drop during 2024.”

The Bank of England’s latest data, published yesterday, showed that mortgage approvals for house purchases rose from 47,900 to 50,100 (4.5%) between October and November, while the annual growth rate for net mortgage lending remained at of 0.3%, the lowest since monthly records began in March 1994.

The latest HM Revenue and Customs data revealed that UK housing sales fell by 22% year-on-year in November 2023.

No comments yet