Prices have dipped year-on-year across the UK with the exception of the West Midlands, Yorkshire & Humberside and Northern Ireland

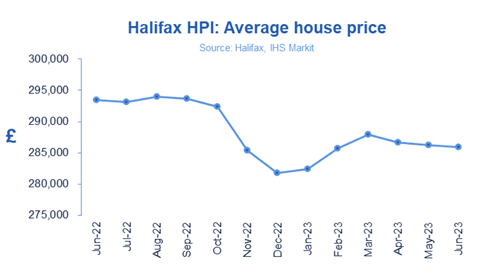

House prices fell in June for the third month in a row, according to the latest figures from Halifax, taking the annual fall to the steepest for 12 years.

In June, the average value of homes fell by 0.1%, with a typical UK property now worth £285,932 compared to £293,992 last August.

This is an annual decline of 2.7%, the biggest year-on-year drop in prices since June 2011.

The biggest decreases were recorded in the South of England where prices are down 3.0% average now £384,106), the largest drop since July 2011.

London recorded an annual decline of 2.6%, with the average property price now £533,057. Prices across the capital have dropped around £15,000 over the last year.

Year-on-year house prices fell across the UK, with the exception of the West Midlands, which recorded 1.5% annual growth, with average house prices now £251,139.

Yorkshire & Humberside recorded marginal annual gains (up 0.2%, £203,674), as did Northern Ireland (up 0.2%, £186,856).

Welsh house prices were down by 1.8% annual (average house price of £215,183), compared to a +1.0% increase in May – the nation’s first year-on-year fall since March 2013.

In Scotland, prices were down slightly on the year (down 0.1% to £201,774), the first annual contraction in property prices in the last three years.

The index suggests some resilience in new-build property prices across the UK, which were up by 1.9% annually.

Prices fell annually in June across all property types, but the decline was steepest for flats (down 3.1%) and terraced homes (down 2.5%).

>>See also: Annual house price growth slows to 1.2%, says Zoopla

>>See also: Mortgage rates reach highest for more than seven months

“These latest figures do suggest a degree of stability in the face of economic uncertainty, and the volume of mortgage applications held up well throughout June, particularly from first-time buyers,” Kim Kinnaird, director of Halifax Mortgages, said in a statement.

“That said, the housing market remains sensitive to volatility in borrowing costs.”

She added: “Concerns about persistent inflation have led to a significant increase in the cost of funding. Coupled with base rate rising by another 50bp, this contributed to a big jump in typical mortgage rates over the last month.

“The resulting squeeze on affordability will inevitably act as a brake on demand, as buyers consider what they can realistically afford to offer.”

Last week Nationwide’s monthly index suggested prices rose 0.1% in June compared to the previous month.

No comments yet