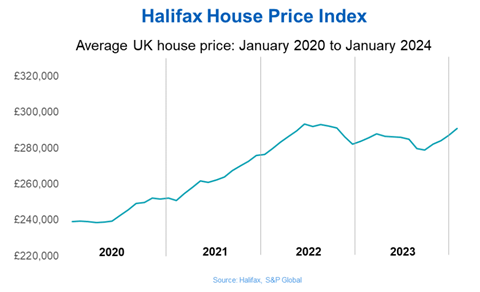

Average property prices rose by 1.3% last month, according to the bank’s house price index

Average house prices rose by 1.3% in January, increasing by £3,924 to £291,029 compared to December 2023, the latest Halifax house price index has indicated.

Average UK house prices have risen by 2.5% year-on-year, but Halifax is not ruling out “modest falls” in house prices this year

Year-on-year, property prices grew by 2.5%, making their annual growth rate its highest since January 2023.

In December’s house price index, Halifax suggested that house prices could fall by between 2% and 4% in 2024, but that uncertainty remains high due to the current economic climate.

In terms of regional changes in house prices, Northern Ireland recorded the strongest growth across all the nations or regions within the UK, with a 5.3% increase in house prices on an annual basis.

>> See also: Average house price up £4,500 in January, says Rightmove

>> See also: House prices up in January but rapid rebound ‘unlikely’ this year, says Nationwide

Average house prices in Scotland and Wales rose by 4% on an annual basis to £206,087 and £219,609 respectively.

The North-west recorded a house price increase of 3.2% over the past year. House prices in Yorkshire and Humber increased by 2.8%, by 2% in the North-east and 0.5% in the East Midlands over the last year.

House prices in the South-east fell by the largest amount last month compared to other UK regions, with homes selling, on average, for £379,220, a drop of £8,866 (2.3%).

Average house prices in London remain the highest across all regions, at £529,528, despite seeing a decrease of 0.4% on an annual basis.

HMRC monthly property transaction data showed that seasonally adjusted residential transactions in December 2023 totalled 80,420, a decrease of 0.8% compared to the 81,070 house sales in November.

The latest Bank of England figures show the number of mortgages approved to finance house purchases increased in December 2023, by 2.3% to 50,459.

Kim Kinnaird, director of mortgages at Halifax, said: “The recent reduction of mortgage rates from lenders as competition picks up, alongside fading inflationary pressures and a still-resilient labour market has contributed to increased confidence among buyers and sellers. This has resulted in a positive start to 2024’s housing market.

Kinnaird added: “However, while housing activity has increased over recent months, interest rates remain elevated compared to the historic lows seen in recent years and demand continues to exceed supply.

“Looking ahead, affordability challenges are likely to remain and further modest falls should not be ruled out, against a backdrop of broader uncertainty in the economic environment.”

Kate Steere, editor and housing expert at personal finance comparison site finder.com, stated: “It’s possible that buyers have also been swayed by recent speculation that the Bank of England could be poised to lower interest rates in the first half of this year. In fact, in a recent panel of experts surveyed by finder.com, 50% predicted that the base rate will be cut in the MPC meeting held on 20 June.

Falling interest rates in the second half of the year combined with the UK’s shortage in housing supply should help drive further price increases by the end of 2024.”

No comments yet