Prices rose 0.5% since March, as HMRC records 66% decline in transactions

Annual house prices increased marginally in May to 3.5%, compared to 3.4% in April, according to the latest index from Nationwide.

House prices were up 0.5% month on month, with the average UK home now worth £273,427.

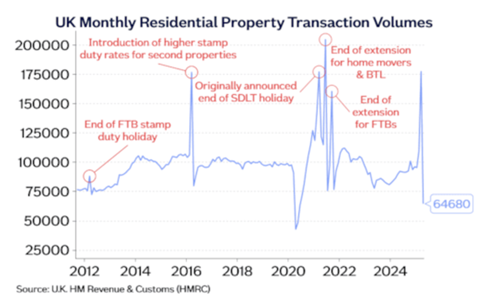

There was a significant drop in the number of residential property transactions in April, following the spike seen in March as buyers tried to beat the rising price of stamp duty.

According to HMRC’s latest estimate, the number of UK residential sales transactions were 64,680 in April 2025 – 28% lower than April 2024 and 66% lower than March 2025.

Robert Gardner, Nationwide’s chief economist, said: “Annual UK house price growth was marginally stronger in May at 3.5%, compared with 3.4% in April. House prices rose by 0.5% month on month, after taking account of seasonal effects.

>>See also: UK house prices rise 6.4% in year to March, says ONS

>>See also: UK house prices drop again in March, Halifax HPI shows

“Official data confirmed that there was a significant jump in residential property transactions in March, with buyers bringing forward their purchases to avoid additional stamp duty costs.

He added: “Owner occupier house purchase completions were around twice as high as usual and the highest since June 2021 (which was also impacted by stamp duty changes).”

Despite the drop in transactions in April Nationwide said mortgage approvals data “suggests that market activity appears to be holding up well.”

Nationwide also indicated that house price growth in predominantly rural locations continues to outpace more urban areas.

It found that between December 2019 and December 2024, house prices in predominantly rural areas increased by 23%, compared with 18% in areas that are largely urban.

No comments yet